UPDATE: May 9, 2016 International graduate workers have been receiving notices from the IRS that their discrepancies have been corrected and they will receive their 2014 tax returns in the coming weeks!

In mid-February international graduate workers began receiving bills from the Internal Revenue Service (IRS) for payments from hundreds to thousands of dollars, because of a discrepancy in the 1042-S tax forms submitted by Columbia University and our tax filings. This is after an almost full year on-going delay in international graduate worker 2014 tax returns. International graduate workers in the union mobilized quickly with our International Student Working Group to organize and hold Columbia accountable to fix the situation. Since we called an emergency tax meeting on February 23rd and continued our efforts for transparency and answers Columbia has made progress to solve this problem, but more still needs to be done. Columbia can do better.

SIGN ONTO OUR PETITION WITH OVER 1000+ SIGNATURES!

Improvements at Columbia; Exciting Tax Update

CROSS-CAMPUS ORGANIZING AND ADVOCACY LEADS TO MAJOR NEW IMPROVEMENTS FOR FUNDED PHD WORKERS On Monday, Provost John Coatsworth and Engineering Dean Mary Boyce emailed PhD students detailing exciting new and improved benefits, which resulted from all our work together to

Intl Grad Workers Receive Refund Notices!

This is what democracy looks like. After multiple delegations to administrators and more than 1,000 petition signers pushing Columbia to do better, international student workers received the following from the IRS: “Any refund due, along with any interest provided by

Huge progress on taxes; Columbia finally offers financial relief!

We have great news about more progress on the international tax issue! Columbia just announced several major steps forward in addressing the problems they created by misreporting our tax deductions to the IRS for 2014. In case you did not

Taxes Q&A Workshop on Monday, March 28th!

Given the success of last year’s Taxes Q&A Workshop, as well as the recent challenges faced by RAs and TAs across campus, GWC-UAW will host another tax workshop on March 28. Please rsvp here and click here to submit your

More int’l tax updates; sign petition; upcoming town hall

Columbia’s Human Resources sent out another e-mail on Monday with additional guidance on how to fix our 2014 tax bills. If you didn’t receive it, read the full e-mail here. After many of us spent hours on the phone with

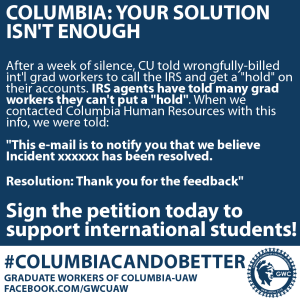

Sign our petition! Columbia can still do better on int’l tax problems

Columbia still needs to do better! Since Tuesday night, when Columbia finally tried to give clearer advice on how to handle their mis-reporting of taxes for international grad workers, many of us have called the IRS. Many grad workers who

Progress on int’l taxes; NLRB update; upcoming town halls

SIGN THE PETITION TO HELP INTERNATIONAL GRAD WORKERS RESOLVE TAX ISSUES We have an important update on our NLRB case below, but since the international grad worker tax issues are extremely urgent, that update comes first in this email INTERNATIONAL

New York elected leaders urge Columbia to take action on international graduate worker tax problems!

Today State Assemblywoman and Chair of the New York Higher Education Committee Deborah Glick, State Assemblyman Daniel O’Donnell, State Senator Bill Perkins, and Councilman Mark Levine signed onto a letter citing Columbia’s negligence in handling the international student IRS bills and

Sign now to tell Columbia to address international tax problems

Sign here to support international grad workers on taxes! Since we have yet to receive any authoritative response from Columbia on our meeting with Dean Alonso last week, the GWC-UAW International Student Working Group has now started a petition to

Update on international RA/TA tax concerns

Thank you to everyone who came to our emergency meeting today on tax concerns for international RAs and TAs – we had a packed room from across Columbia representing GSAS, Engineering, Lamont, and CUMC, and, because of our extreme disappointment

|

Apr 15, 2015

|

For the 2014 tax year, 14% of any US income was withheld before entering international graduate students’ bank accounts. The main withholding agent is Columbia University as international students cannot have jobs outside campus. |

|

Sep 18, 2015

|

First IRS letters received, informing international students of the problem with the 1042-S form, line 62d. This was a nation-wide problem described as a ‘major glitch’. This resulted in an initial system freeze of 6 months (180 days), delaying tax returns, and was then extended for another 168 days.

No information was sent out by any administrative body at Columbia University, informing international students of the scale of the problem and possible solutions if they were facing financial hardship as a result of delayed tax returns. |

|

Feb 16, 2016

|

Second IRS letters received, stating:

The information you supplied does not match the information we received from Form 1042-S, Foreign Person’s U.S Source Income Subject to Withholding, filed by your withholding agent. The inaccuracy and discrepancy is about Line 62d, the line that states the ‘tax withholding credit’. The 1042-S forms sent to Columbia to international students listed how much of their income was withheld, but the 1042-S’ Columbia submitted to the IRS does not show any dollar amount. No communication from Columbia administration. |

|

Feb 22, 2016

|

IRS bill received as a letter, charging international students a penalty for the mismatch in reporting and for a whole year of late tax payments in amounts ranging up to thousands of dollars. The deadline for students varies from March 4 to March 15.

No communication from Columbia administration. When individuals contacted International Students and Scholars Office (ISSO), they were referred to the Human Resources (HR) and specifically Carlos I Lira-Coppo. HR admitted knowledge of the problem, but in their correspondence with individual students, they blatantly stated that they will only contact the students who had managed to reach HR and inform them of any solutions they come up with. There was no intention on the part of the administration to admit that this was a problem faced by all international students across campus because of a problem that Columbia administration was responsible for. |

| Tuesday

Feb 23, 2016

|

The international working group of Graduate Workers of Columbia (GWC) recognized the problem as a collective problem and called for an emergency meeting to be held on Thursday, February 25 at 10am. |

|

Wednesday Feb 24, 2016

|

At 10am, only GSAS international students received the first communication from any administrative body at Columbia University after the GWC had called for an emergency meeting. In their haste, the Office of the Dean stated:

The problem stems from the data file that the University’s vendor for Tax Treaty processing sent to the IRS, data that serve to verify to the IRS the information that you entered on your 2014 tax filing. The file sent to the IRS by the vendor contained incorrect information, and that discrepancy automatically triggered the e-mail message that you received. Apart from the obvious misinformation about this being sent by IRS as an e-mail, the Office of the Dean also suggested that, “please be patient while the vendor resolves this mater with the IRS. We reiterate that you should not be alarmed by this regrettable yet transitory event.” [all spelling mistakes are reported as exactly as it appears in the email] At 9pm, Human Resources sent an email to international students across campus giving conflicting information by stating that, [the IRS] notice was issued in error. Please rest assured that the information you received on your 2014 1042-S is correct. You DO NOT need to pay the amount on the IRS notice you received about this issueThe notice was issued because of a problem in the software the University uses to verify earnings data with the IRS. The software is configured by a third-party vendor and is used by many of Columbia’s peer institutions. Colleagues at those institutions report that the same configuration has caused similar problems for their students. |

|

Thursday Feb 25, 2016

|

At 10am, over 50 international graduate students attended the emergency meeting with many more emailing the organizers saying that they are unable to attend but would like to be informed of the proceedings. After discussing concerns, a list of demands was drawn with the top priority for Columbia to admit responsibility and sort this for all international students without putting the responsibility on them individually.

At 11:30am, a delegation of international students from the meeting marched into Dean Alonso’s office demanding an audience with him. After half an hour Dean Alonso agreed to meet with the delegation, admitting that he had not received any legal council before sending his advice that we should not take the forms received from the federal government seriously and not pay the fines we owe the IRS. He also did not admit or take any responsibility for the issue, specially saying that he is only Dean of GSAS and is not responsible for the rest of the university. The delegation left and told Dean Alonso the union would pushing for the rightful demands of the collective body of international students and for Columbia to admit responsibility as their ’employer’. At 12pm, Ellie Bastani, the Assistant Dean of Graduate Student Services and Post-Doctoral Affairs in School of Engineering and Applied Sciences (SEAS), circulated the exact email sent out by the Office of the Dean of GSAS, with all its misinformation and unfounded legal advice. At 1pm, a member of the organizing committee of the international wing of GWC met with the head of ISSO, David Austell. He had no idea what was going on and admitted he has no power whatsoever to act and protect international students. |

|

Friday Feb 26, 2016

|

At 5pm, HR sent a second email stating,

We understand that thousands of students from universities throughout the country have received this notice in error. Columbia, alongside its peer institutions, is working with our vendor to provide you with additional information and help resolve the situation as quickly as possible. The new advice was for internationals to wait for more information from HR and reiterated that, “you DO NOT need to pay the amount listed on the notice. We do advise you to retain all documents you receive from the IRS.” Columbia still did not admit any responsibility and the HR is yet to respond to individual responses sent to this email asking for the legal basis of the conflicting advice that international students are receiving. |

|

Monday Feb 29, 2016

|

The GWC sent out a petition for all graduate students to sign, listing a set of demands for Columbia university to take responsibility and to negotiate on behalf of ALL international students with the IRS, to provide funds and compensations, and to hire a CPA to provide proper legal advice to international students. |

| Tuesday

Mar 1, 2016 |

At 11am, the second emergency meeting of international graduate students was held.

At 11:40am, a delegation delivered the petition with more than 400 signatures collected in less than 24 hours to the Provost, John Henry Coatsworth. He refused to meet with the delegation. At 3pm, GWC announced that New York elected officials have demanded immediate action from Columbia administration. State Assemblywoman and Chair of the New York State Assembly Higher Education Committee Deborah J. Glick, State Assemblyman Daniel O’Donnell, State Senator Bill Perkins, and Councilman Mark D. Levine signed onto a letter citing Columbia’s negligence in handling the international student IRS bills and urging the administration to provide assistance to resolve this issue. At 6pm, HR sent out an email addressing international students by their first names, advising them to take several actions as individuals with the IRS to put their accounts on hold until the issue is resolved. These actions included calling the IRS as well as re-sending all tax forms and information filed for the tax return. They also stated, This IRS notice is incorrect and should not have been sent. Columbia University has verified and is confident that the 2014 1042S you received is accurate. They also admitted that, The University has contacted the IRS and has retained PricewaterhouseCoopers to assist with this. (We cannot act on your behalf with the IRS without getting power of attorney from you.) HR did not offer to get power attorney in order to solve this issue collectively. They have put all the work for their mistake on individual international students without any guarantee that the IRS would be responsive to our request for our accounts to be places on hold, any provisional timeline for when this issue will be resolved, and finally when international students will be relieved of the financial burden that they have faced for the past year. Since this email many international students have faced numerous difficulties in contacting the IRS and putting their accounts on hold. No further information has been provided by the Columbia administration since, and inquiries for help have been largely unanswered. International students are yet to receive any guarantees that this will not happen again and that this will not affect their record with the IRS and the federal government in the future. |